Alternative Investment Fund

Pooled Investments made in venture capital, private equity, hedge funds, managed futures etc. are called alternative investments. In other words, an investment not made in conventional investment avenues such as stocks, bonds, real estate etc. may be considered as alternative investments.

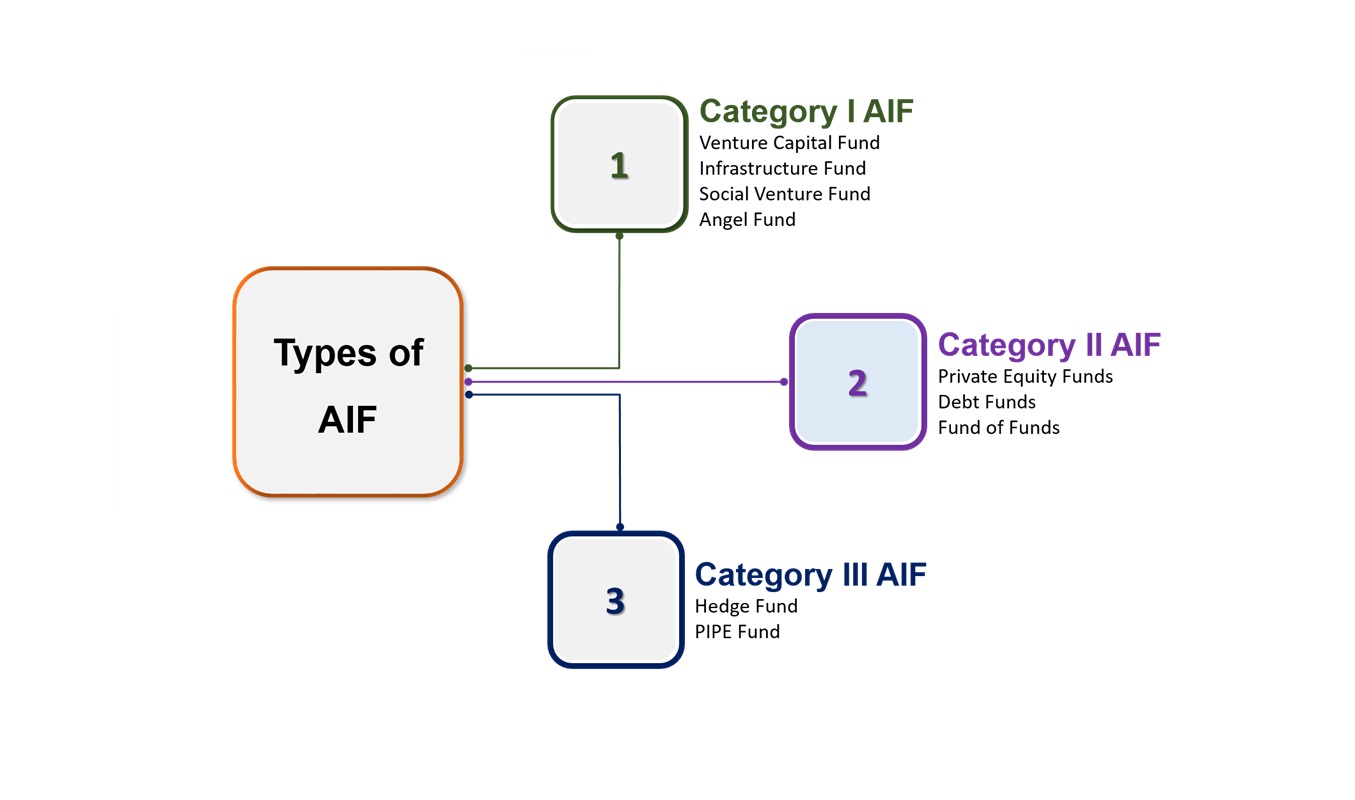

As per SEBI, AIFs are classified in three broad categories. Category I & II AIF are close ended & the tenure of the scheme is minimum three years. Whereas Category III AIF can be open ended or close ended.

Category I AIF

Mainly invests in start- ups, SME’s, social ventures, venture capital, infrastructure or any other sector which Govt. considers economically and socially viable for the Indian economy.

e.g. Venture Capital Fund, Infrastructure Fund, Social Venture Fund, Angel Fund

Category II AIF

These include Alternative Investment Funds such as private equity funds or debt funds which invest in equities and/or debt securities and which are not provided by any specific incentives or concessions by the government or any other Regulator.

Category III AIF Funds that engage in a variety of or complex trading techniques, such as investing in listed or unlisted derivatives, fall into Category III. Hedge funds are typically included in this category. These are normally Open-ended funds

e.g. Hedge Fund, Private Investment in Public Equities (PIPE) Fund