Critical Illness Insurance

There are many people like Kavya and her husband who don’t know the benefits of a critical illness insurance policy. And even if they are aware, they cannot decide if they should buy one or not.

Critical Illness Insurance

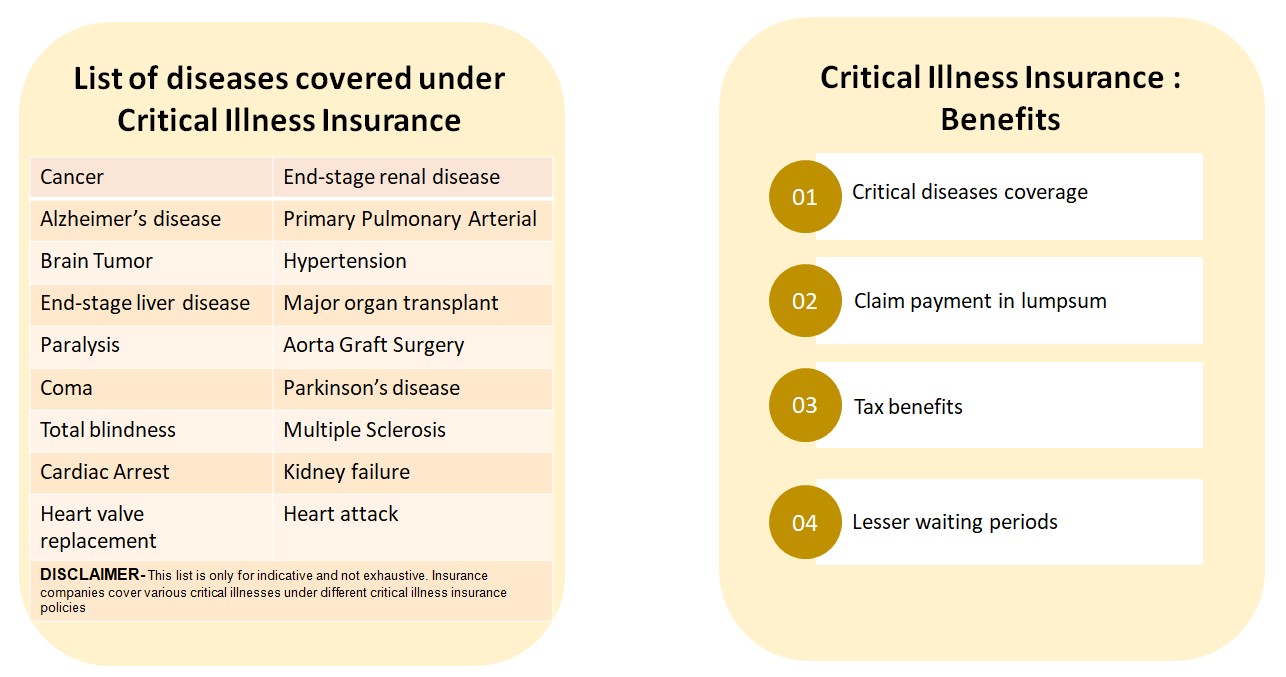

A basic health insurance policy may not be sufficient to cover all medical costs, especially in case of CI which require long-term treatment, leading to a huge financial burden. This financial burden can be supported by a special financial protection plan called ‘Critical Illness Plan’.

You should purchase a critical illness plan along with a health insurance plan. It is advisable to buy a critical illness plan at an early age as health risks are less and so a lower insurance premium. The premiums which are paid for a critical illness plan are allowed as a tax deduction under Section 80D.