Who doesn’t love fixed income?

Most investors are always looking for fixed income products. Our love for ‘fixed income’ is why nearly 50% of Indians still invest in fixed deposits!

There’s nothing wrong with investing in fixed deposits. They are safe and perfect for low-risk investors or for short term goals.

But the problem is people lack ‘smart investing’. For example, If you use our unique “FD Progressive System”, you can enhance your returns with same FD in same bank.

Also another problem is our understanding of the term ‘fixed income’. Most investors believe that fixed income is equal to fixed deposits. But this is wrong.

Fixed income includes everything from treasury bills to corporate bonds. The fixed income market in India offers superior returns than bank deposits. Lack of knowledge is the reason why investors prefer savings accounts and bank deposits.

In a nutshell, Fixed income is linked to capital preservation and income generation. Fixed income is a safer alternative to stocks because it is a steady income stream with less risk.

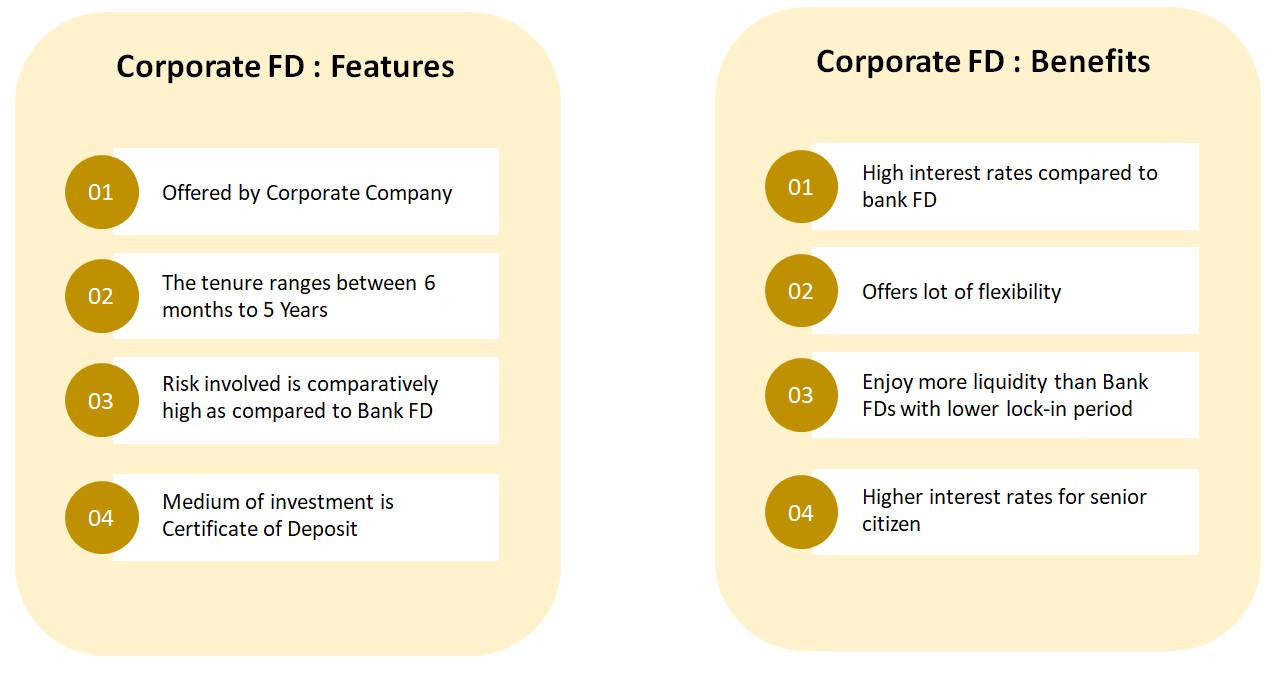

Like bank fixed deposits, many corporate companies, NBFCs, and financial institutions collect funds from the public and deposit them for a fixed term, and pay fixed interest. The deposits collected by firms are referred to as corporate fixed deposits similar to banks; they also provide interest on the amount invested. When investors invest in corporate fixed deposits they are issued deposit certificates of different tenures (1-5) at fixed interest rates.

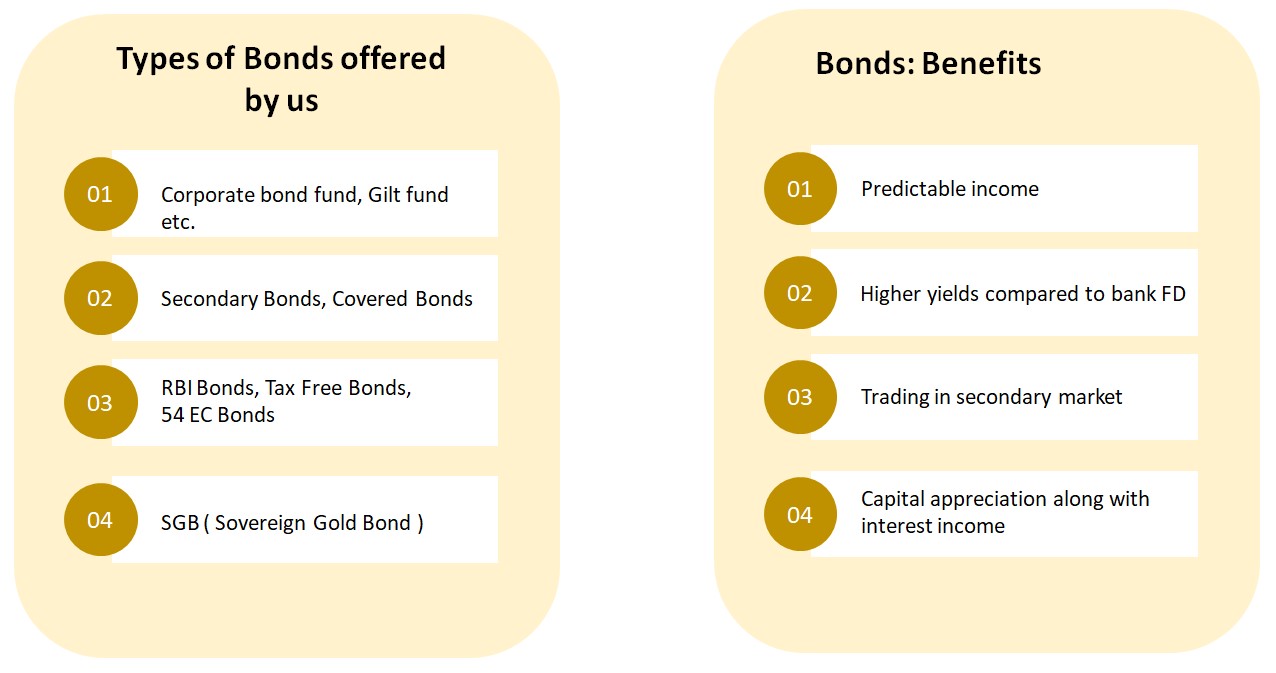

Maintaining and managing investment portfolio is crucial for an investor. A well managed portfolio is known to maximize your return irrespective of market condition. It has been increasingly difficult for an individual investor to understand the bond market and it’s long term importance.

It is no longer about choosing between stocks and bonds. Smart investors don’t run the risk of putting all their money in one place. Before the market starts twisting your arm into menacing your portfolio, have a strong arm strategy.

A bond is a debt instrument in which an investor loans money to an entity (typically corporate or government) which borrows the funds for a defined period of time at a variable or fixed interest rate. Bonds are used by companies, municipalities, states and sovereign governments to raise money to finance a variety of projects and activities. Owners of bonds are debt holders, or creditors, of the issuer.

Features of Bonds :

- Par value refers to the value stated on the face of the bond, which shows the amount which the company or government body promises to pay at the time of maturity.

- Coupon Rate is nothing but the fixed rate of interest payable to the bondholder.

- Maturity Date is the date at which the bond gets matured, and the principal amount is paid to the bondholder.

- Redemption Value is the value paid to the bondholder, at the time of expiry of the term for which bond is issued.

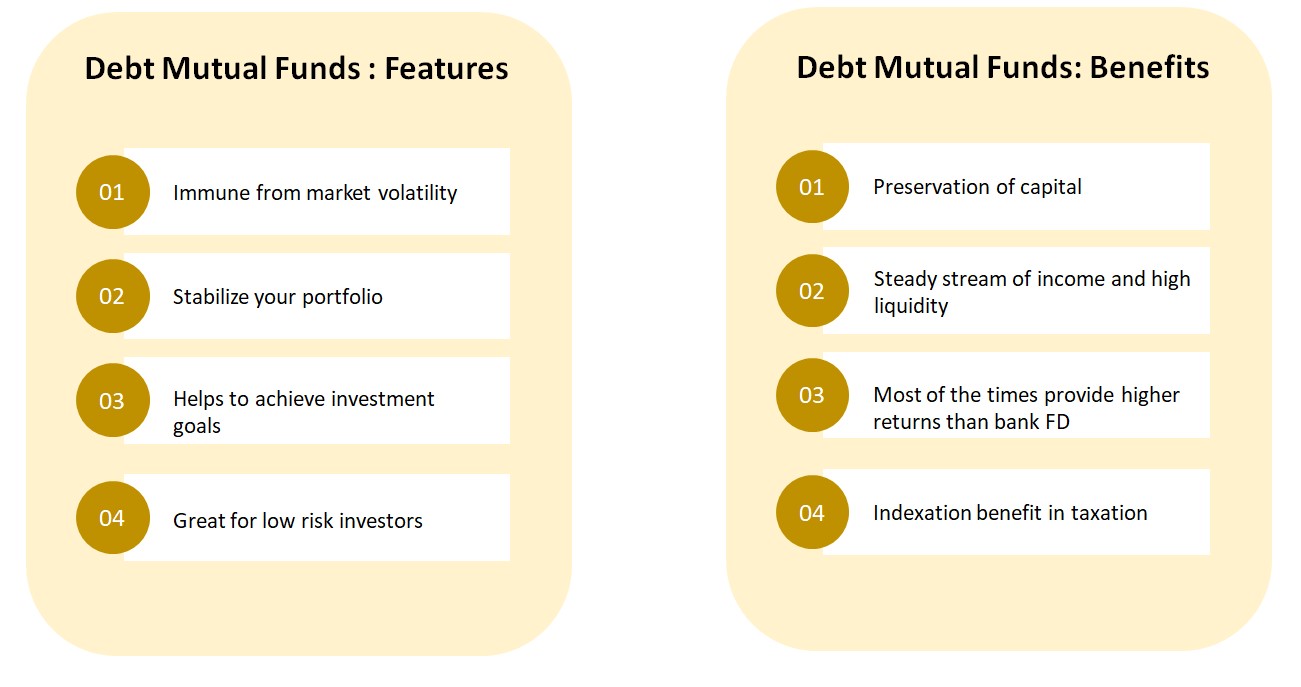

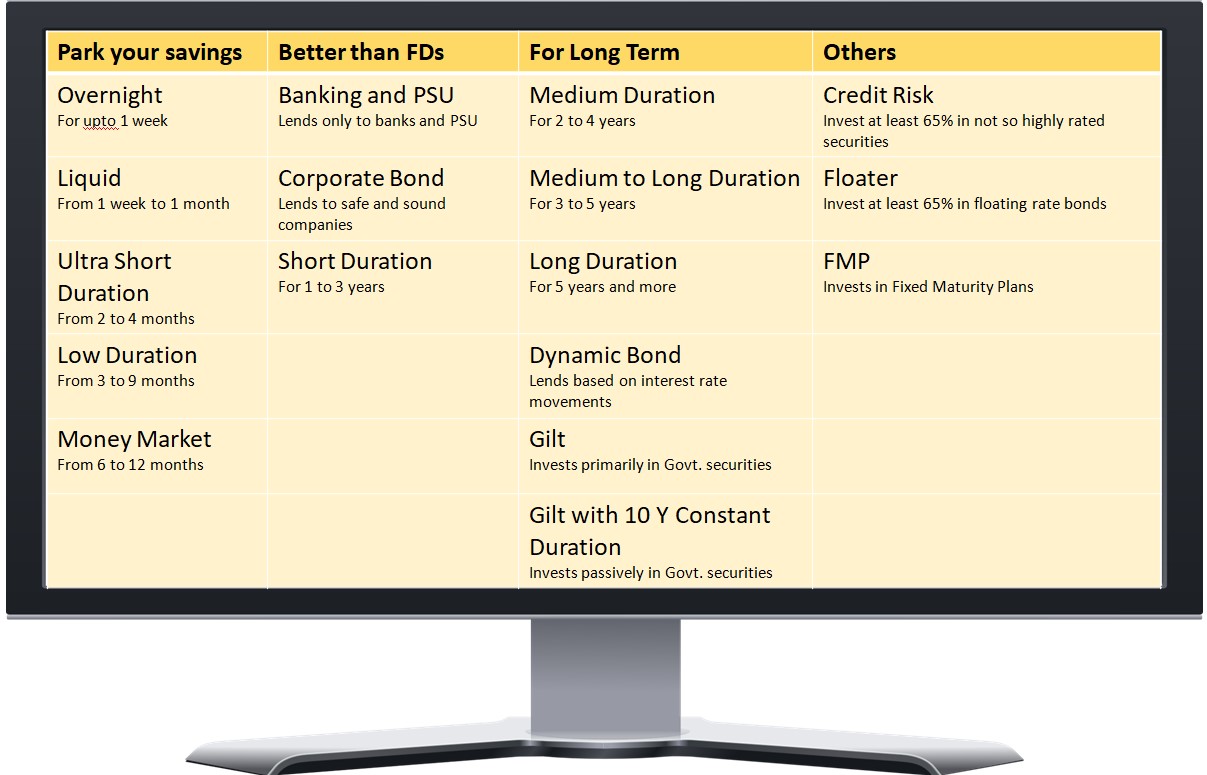

Debt funds are mutual fund schemes which invest in fixed income generating securities such as Commercial Papers (CP), Certificate of Deposit (CD), Corporate Bonds, T-Bills, government securities and other money market instruments. These instruments have a fixed maturity date and interest rate that the buyers could earn till the maturity of the security. They are considered to be less volatile than equity funds and are hence ideal for investors who are relatively risk averse and are looking for stability in their investments.

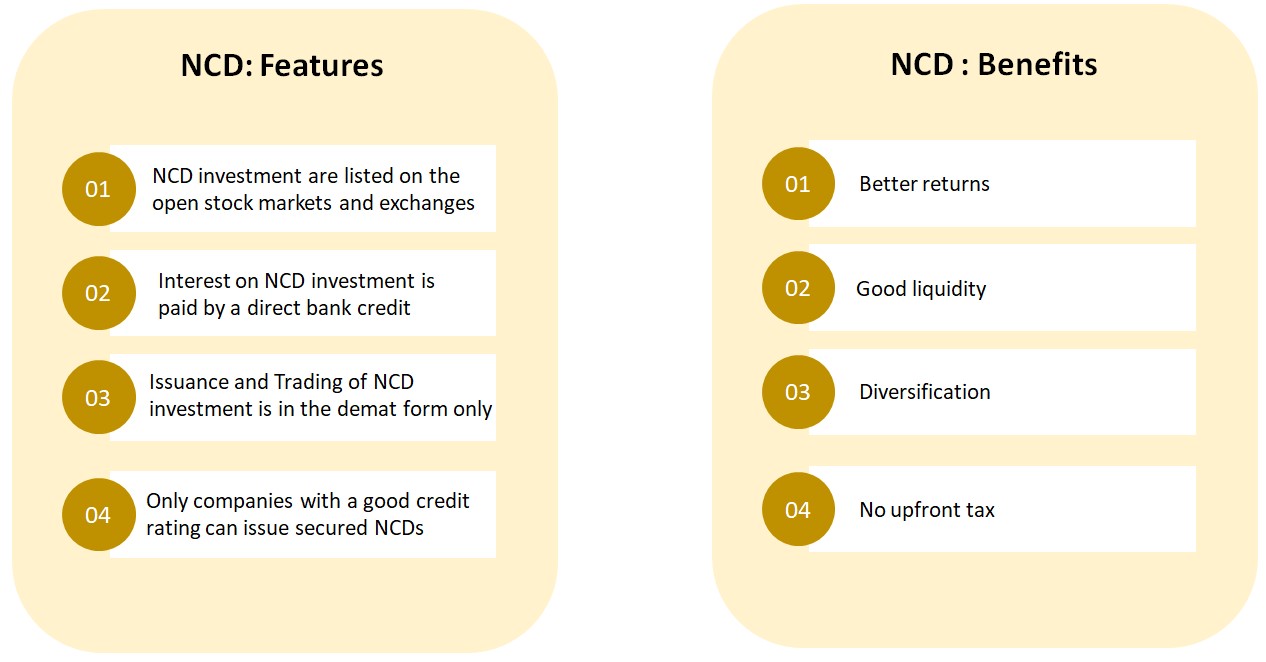

Investors want investment options that manage liquidity and risks while offering substantial returns. Debentures are long-term financial instruments issued by a company for specified tenure with a promise to pay fixed interest to the investor.

Debentures are of two types, namely convertible debentures and non-convertible debentures (NCD).

Non-convertible debentures (NCD) are those which cannot be converted into shares or equities. NCD interest rates depend on the company issuing the NCD. NCD investment can be held by individuals, banking companies, primary dealers other corporate bodies registered or incorporated in India and unincorporated bodies.