Portfolio Management Service (PMS)

Portfolio Management Service (PMS) is a unique and customized fund management service provided normally to high net worth (HNW) and Ultra high net worth (UHNW) investors.

The beauty of PMS is that it creates a unique portfolio for you since your needs and your risk appetite are also unique. That is unlike a mutual fund which creates a single macro portfolio under a scheme and all fund holders just get a share of that.

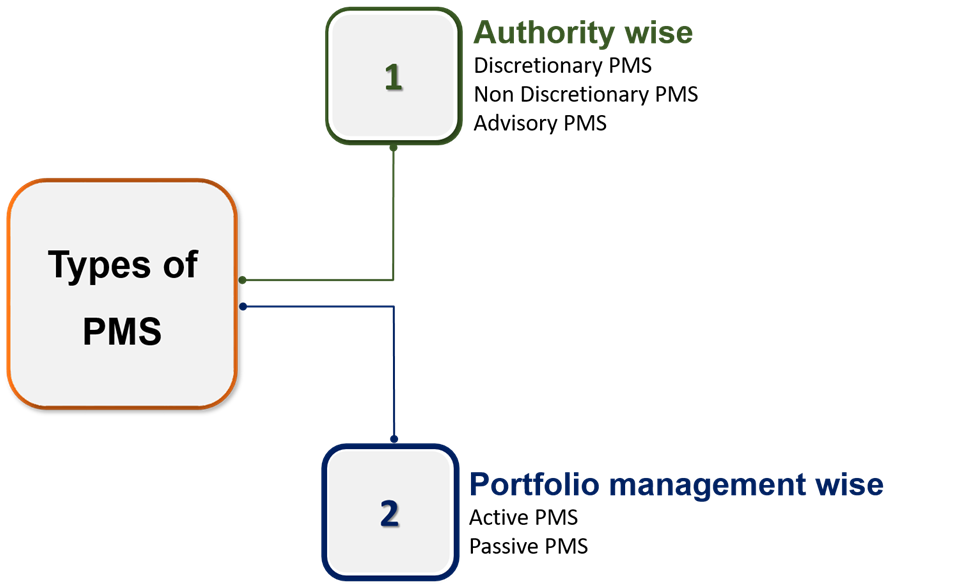

Types of PMS :

Although different companies offer different types of portfolio management services, there are some standard categories or types of PMS . They are as follows:

- Discretionary PMS : Under this, the portfolio manager has the full discretion to decide not only what to buy and what to sell but also when to buy and when to sell which means PMS has full flexibility in operation.

- Non-Discretionary PMS : Under this, the consent has to be taken from the investor by the portfolio manager before investing. But the assets are always under the control of portfolio manager.

- Advisory PMS : This service is largely used by family offices. The advisory services are basically about the portfolio manager giving non binding advice to the investor. The investor then could decide as per their profile and risk appetite whether they would like to go ahead with the investments or not.

0

+

Happy Clients

₹ 0

+

Clients Freedom Wealth Target

0

+

Our Team Size

0

+ Yr.